Are all Floating Rate funds Equal?

This article touches on the benefits a Floating Rate fund could add to a Fixed Income portfolio, examples of Floating Rate Funds, and whether all Floating Rate Funds are equal. I’ll begin with a few definitions and context, but for those that are more visual we’ve added some charts toward the end.

First off, there are several types of Securities that are floating rate such as FRN, ABS, MBS, and CLOs. However, I’ll focus this article primarily on Collateralized Loan Obligations (CLOs). The article is meant to be an overview, and for more detailed info on CLOs I recommend Guggenheim’s CLO Primer (here) or Pinebridge’s CLO Primer (here).

Collateralized Loan Obligations (CLOs): An Overview

A Collateralized Loan Obligation (CLO) is a type of investment vehicle that pools together a diversified portfolio of loans and then issues multiple classes of debt and equity securities, backed by the cash flows generated from the underlying loans. CLOs are managed by investment managers, who are responsible for selecting and managing the loan portfolio.

The underlying loans in a CLO are typically floating rate loans made to corporations, and consist of a variety of tranches, each with a risk/return profile based on its seniority and claim priority on the cash flows produced by the underlying loan pool. Also known as bank loans or leveraged loans, these loans are typically first-lien position in the company’s capital structure, are secured by the company’s assets, and rank first in priority of payment ahead of unsecured debt in the event of bankruptcy. Because the loans are floating rate, they typically offer higher yields than traditional fixed-rate bonds, which can be attractive to investors.

Benefits of Investing in CLOs

High Yield Potential: CLOs can offer attractive returns to investors, often with yields that are higher than traditional fixed income investments. The further down the capital structure you go (AAA, AA, A, BBB, BB..), the higher yield potential. The spread between CLOs and IG Credit ranges from around .7% at AAA to over 5% at BB and over 6.5% at B.

Diversification: CLOs can provide investors with exposure to a diversified portfolio of loans, which can help to spread risk across different borrowers and sectors. This can be particularly attractive for investors who are looking to diversify their portfolios and reduce their exposure to any single borrower or industry.

Credit Quality: CLOs are typically structured so that the most senior tranches of debt are the first to be repaid from the cash flows generated by the underlying loans, which means that these tranches typically have a high credit quality. This can help to reduce the risk of default and provide investors with a measure of safety.

Low Correlation: CLOs may have a low correlation to other asset classes, such as stocks and bonds, which can make them an attractive addition to a diversified portfolio. This can help to reduce overall portfolio risk and potentially enhance returns.

Professional Management: CLOs are typically managed by experienced investment managers who have expertise in selecting and managing the loan portfolio. This can provide investors with a level of comfort and confidence that their investment is being managed by professionals.

Risks of Investing in CLOs

Since I addressed the benefits, I should also state the risks. While investing in CLOs can offer attractive returns and diversification benefits, it is important to note that, like most investments, they do carry certain risks. For example, credit risk, default risk, interest rate risk, and liquidity risk.

I’ll address a couple of these risks, specifically Default, Interest Rate risk, and Liquidity risk. However, first, I feel it’s important to provide a little background on the different Generations of CLO’s before we show a couple of charts.

Status Quo of CLOs

At times you’ll see the terms "CLO 1.0" and "CLO 2.0". These are used to refer to two different generations of CLOs, which were structured differently and originated during different time periods.

CLO 1.0 refers to the first generation of CLOs, which were issued prior to the 2008 financial crisis. These CLOs typically had a simpler structure, with most of the debt issued in a single tranche. CLO 1.0 deals also tended to have a larger proportion of lower-rated tranches, which were less senior and carried higher risk.

CLO 2.0 (and 3.0), on the other hand, refers to the more recent generation of CLOs, which were structured differently in response to the lessons learned during the financial crisis. These CLOs typically have a more complex structure, with multiple tranches of debt and equity issued. CLO 2.0 deals also tend to have a smaller proportion of lower-rated tranches, and a larger proportion of higher-rated tranches, which are more senior and carry lower risk.

In addition, CLO 2.0 deals often incorporate more rigorous risk management and monitoring practices, such as more frequent loan covenants and greater transparency around loan data. These changes were made to address some of the weaknesses that were exposed in the CLO 1.0 market during the financial crisis, such as inadequate risk management and a lack of transparency.

Overall, the main difference between CLO 1.0 and CLO 2.0 is in their structure and risk profile. While CLO 1.0 deals were generally simpler and carried higher risk, CLO 2.0 deals are typically more complex and have a greater focus on risk management and transparency. It’s important to note that less than 1% of the market remains in CLO 1.0.

Addressing Risk Concerns

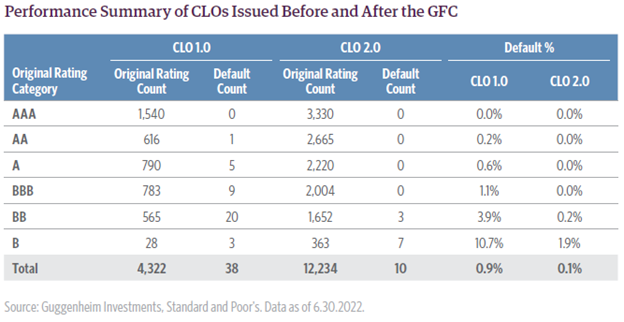

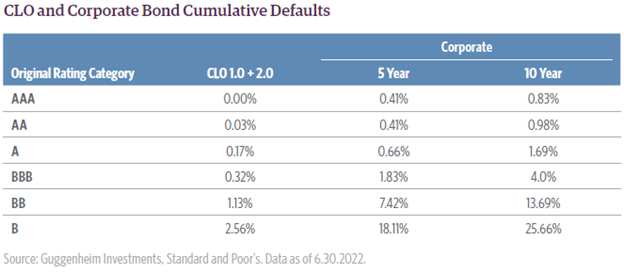

Now, to put some context to the risk of investing in CLOs, specifically default and interest rate risk, I’ll start with a couple of charts showing default percentages (Focus on CLO 2.0 because that is the vast majority of the market and most likely the only generation that investment managers are investing in):

As you can see the default rates are quite good when compared to Corporate defaults, especially with regards to CLO 2.0 and the more senior tranches (“0” for BBB and above), which as mentioned (along with CLO 3.0) makes up 99%+ of the market.

Now to address Interest Rate Risk. CLO tranches are floating rate and priced at a spread above a benchmark (such as SOFR). As rates rise or fall, the yields will move accordingly, and historically less than those of other fixed-rate instruments, which adds an advantage to a diversified fixed income portfolio, a hedge against inflation, and spread duration.

Finally, briefly on Liquidity Risk. On average, there is approximately $300M worth of AAA, AA, and A CLOs trading daily. Liquidity is often most concerning in a bad market, and so when these happen an investor would most likely consider owning high quality. Therefore, it would be prudent for an investor to understand whether or not their portfolio contains high quality investments and the potential safeguards it provides against liquidity risk.

Funds that invest in CLOs

The CLO Market makes up more than $950B of the Leveraged Loan Market that is $1.4T+ in size, and there are many funds that invest in CLOs but for this article I’ll just focus on 3 of them (Full disclosure I do work closely with Leader Capital, otherwise chosen due to their stated investment into CLOs).

1. Leader Capital High Quality Floating Rate Fund (LCTIX): This mutual fund's investment objective is to provide current income while maintaining low volatility of principal. The Fund invests primarily in High Quality Floating Rate CLOs, with a focus on those backed by senior secured loans and focuses on High Quality CLOs with an average credit quality of "A" or higher.

2. Voya Senior Income Fund (XSIIX): This mutual fund's investment objective is to seek a high level of current income consistent with the preservation of capital. The fund invests in a diversified portfolio of senior secured floating-rate loans, including loans issued by High Quality Floating Rate CLOs, and seeks to maintain an average credit quality of "BB-" or better.

3. PGIM Floating Rate Income Fund (FRFAX): This mutual fund's investment objective is to seek current income and, as a secondary objective, capital preservation. The fund invests primarily in senior secured floating-rate loans, including loans issued by High Quality Floating Rate CLOs, and seeks to maintain an average credit quality of "BB" or better.

So far, so good, they all sound fairly similar, but there is one subtle difference and that is the average credit quality. Leader Capital is the only one that mandates an average credit quality of “A” or better. So, what’s the big deal, the others having an average credit quality of “BB-“ and “BB”, isn’t that close enough, and besides the previous charts show minimal defaults?

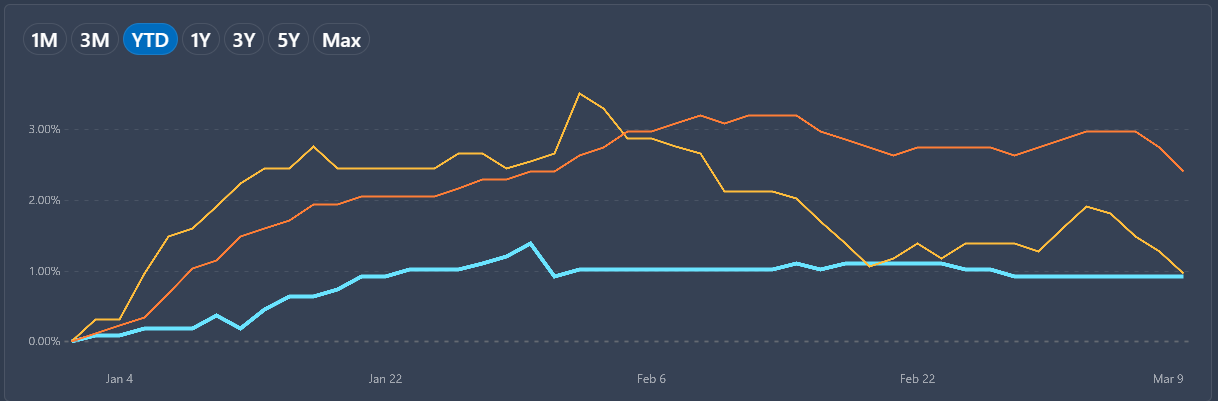

Let’s take a look at the difference from a price performance perspective. Below is a YTD Chart through 3/10/23. (Leader Capital is “Blue”, Voya is “Gold”, and PGIM is “Red”.)

From the looks of things they all look comparable and you would have done a little better to start the year investing in Voya or PGIM, with PGIM performing better as of late.

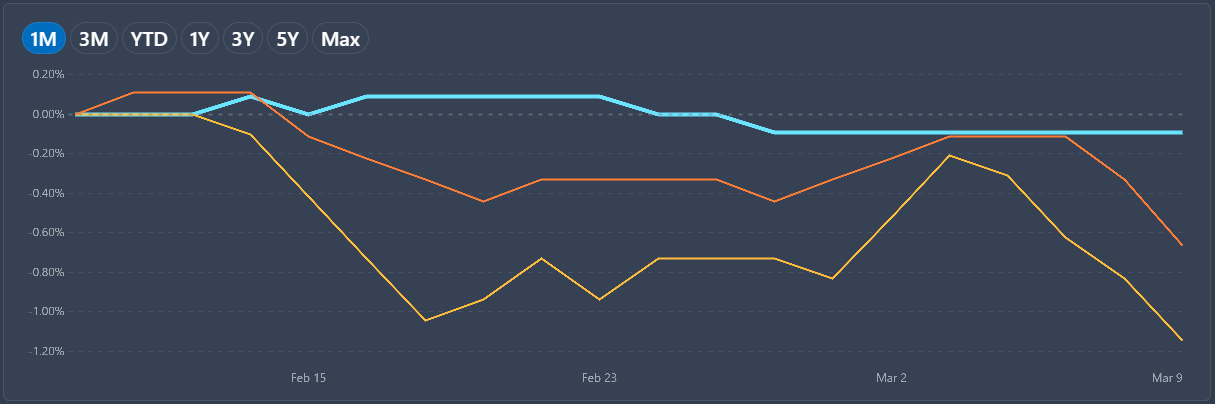

In the next chart, you’ll see that It was over the last month through 3/10/23, where Leader Capital made up ground as we saw credit markets sell off a little again:

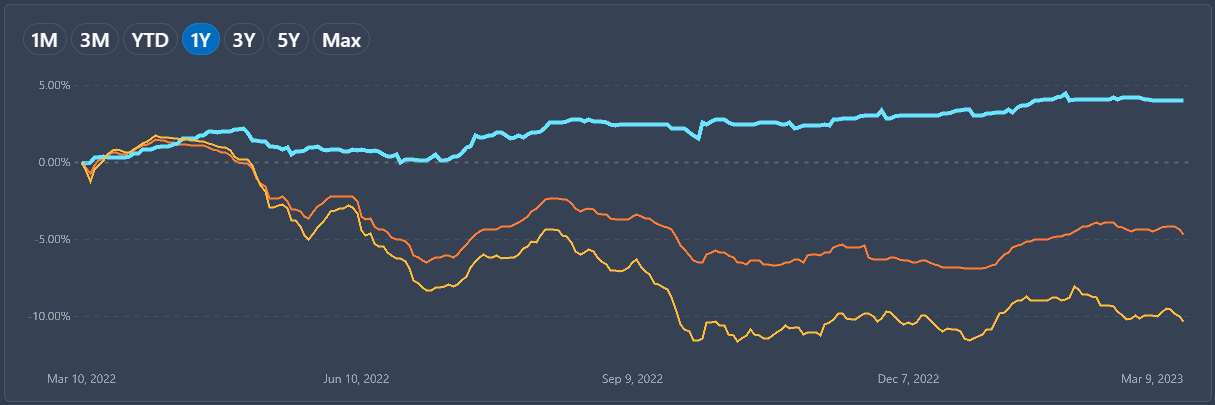

However, long term performance provides a better picture when considering an investment and not just 1 or 3 months. Therefore, let’s look at the 1 Year and 3 Year.

First, the 1 Year:

Now the 3 Year:

The above charts are snapshots for illustrative purposes showing the price percentage change, but for those interested in seeing the Total Return (from Morningstar as of 3/10/23), here they are (also included vs. AGG):

Providing a longer-term look makes it easier to see the difference between the funds with credit quality being a major factor. Some financial professionals I’ve personally spoken to have said they’ve been burned by floating rate in the past, and you can see why.

Answering the questions

Moving down in quality with XSIIX and FRFAX you’ll pick up more yield, but is the price worth it (just ask Silicon Valley Bank)? Taking a little less yield (with high quality) for less volatility has been a nice tradeoff, and if more would have accepted this tradeoff, we may have seen less articles about whether or not the “60/40 Portfolio is dead!”.

Overall, CLOs can be an attractive investment option for investors who are seeking high yields, diversification, and professional management. However, it is important to conduct thorough research and due diligence before investing in CLOs, and to consult with a professional who can help determine if they are appropriate for your investment goals and risk tolerance.

My hope is that this article provides a little background and insight into CLOs, and their potential fit into a Fixed Income portfolio.

Regarding answering the question, is all Floating Rate the same? The answer, not exactly, but you can compare apples to apples (or in this case tranche to tranche). Finally, to answer the title of the article, are all Floating Rate funds the same? Definitely, not.

If you stuck with me through the entire article and would like to learn more, please don’t hesitate to reach out.